During his budget speech for 2023-24 in the National Assembly of Pakistan, the Finance Minister, Ishaq Dar announced that all materials used for manufacturing solar modules would be exempted from duties. However, without sufficient and uninterrupted electricity, manufacturing PV modules would be impossible. For example, crystal pulling and making silicon wafers require hundreds of kilowatts of power without any interruption. Moreover, all other processes involved in PV module manufacturing also require significant amounts of uninterrupted power. Even small industries need standby generators due to the uncertain supply of electricity.

While it’s possible to import all parts duty-free, achieving a competitive price for locally-manufactured PV modules is questionable. China, which produces more than 90% of the world’s PV modules, has a significant advantage due to low raw materials and manufacturing costs. Let’s forget about the quality for a moment and consider whether Pakistan can manufacture per watt of PV modules at a lower or equal price than what China offers. Those who want to experiment can visit the non-operational 10 MW PV modules production plant at PCRET in Islamabad. Bulk imports of Grade-A PV modules from Tier-1 brands from China, going by Pakistan’s Vision-2025 for Green Energy Scheme, will be distributed nationwide with subsidized prices to promote solar energy. Standardized specifications and minimum efficiency should be set as import criteria to protect end-users from low-quality PV modules.

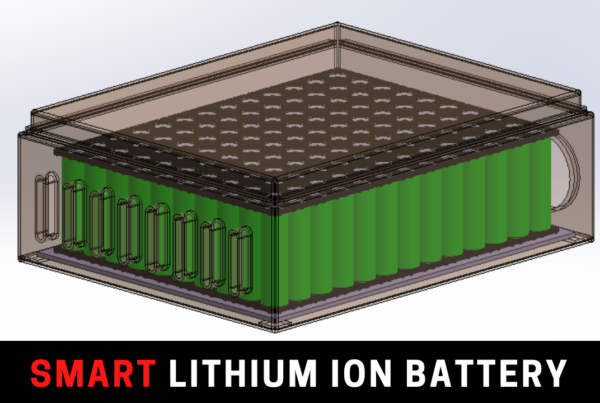

Also, measures should be taken to stop illegal imports of solar products. The lifting of customs duties on battery manufacturing materials will definitely promote the cause, as long as they are intended for solar tubular or lithium (LiFeO4) batteries only. While PV modules have already been exempted, the exemption now also extends to materials, machinery and inspection/testing equipment used in relation to solar cells and PV modules. Assemblers of solar panels, known for importing other solar materials, have already been implementing this practice.

The promotion of local solar module manufacturing in Pakistan presents a complex situation. While consumers are pleased with the duty exemptions, several key factors need to align for this vision to become a reality. Importers must have confidence in the continuity of the government’s policy to invest in the necessary equipment. However, competition with China, which benefits from trained manpower and cost-effective raw material sourcing from Taiwan, poses a challenge. China prioritizes its own industry and raises concerns if imports are made through Taiwan, resulting in higher per watt costs.

Furthermore, the allocation of sufficient energy to Special Economic Zones (SEZs) where solar module manufacturing is established is crucial. The energy demand for processes like ingot production, wafer-slicing, infusion, and tedlar packing is substantial and requires a considerable allocation from the generation capacity of dams or other power sources.

Another hurdle lies in the perception of Chinese brands, such as Jinko, JA, and Longi, which enjoy widespread recognition and acceptance among Pakistani consumers. Local brands, including Tesla Industries, Nizam Energy, and Sunlife solar panels, face challenges in gaining consumer trust and satisfaction. Similarly, brands like ZnShine, Leapton, DuPont, AE Power, as well as OEMs like Mesol’s Alpha and Inverex’s Mustang, also struggle to meet consumer expectations. While solar import duties are already exempted on modules, the consumer can lest get any further advantage. The exclusive production of solar tubular batteries by Senator Talha Haroon’s Pakistan Accumulator (Osaka) and Exide by Altaf Hashwani or Pheonix Ch Javed Iqbal Siddiqui limits any additional benefits for consumers. They are the giants and they would further monopolize and mint benefits.

In summary, overcoming the chicken-and-egg scenario of local solar module manufacturing in Pakistan requires building importer confidence, addressing competition with China, ensuring energy allocation to SEZs, and establishing strong consumer trust in locally produced or assembled brands.