Pakistan’s latest power-sector announcement is being widely discussed, and just as widely misunderstood. Strip away the noise and the takeaway is precise: the relief is on wheeling charges via removal of cross-subsidies, not a blanket reduction in base electricity tariffs.

Speaking on the matter, Shehbaz Sharif indicated that industrial consumers will see an effective reduction of Rs 4.04 per unit, taking wheeling charges down to roughly Rs 8.5–9 per kWh from levels near Rs 12.5. This adjustment comes from eliminating a cross-subsidy component that had been embedded in wheeling costs.

For industrial energy users—and especially for businesses exploring solar, captive power, or third-party supply—this is a structural change, not a headline gimmick.

What is a Wheeling Tariff (and why industries should care)

A wheeling tariff (or wheeling charge) is the fee paid to a utility for transporting electricity across its transmission or distribution network when the power is generated by a third party rather than the local DISCO.

In simple terms:

Wheeling allows electricity generated at one location—say, a private solar plant—to be delivered to a consumer at another location using the public grid.

Key aspects of wheeling tariffs:

• Purpose:

Covers the cost of using grid infrastructure, including operation, maintenance, and technical losses during transmission.

• Components:

Typically includes transmission charges, distribution charges, and loss compensation at different voltage levels.

• Usage:

Enables open access, allowing bulk and industrial consumers to procure power from competitive suppliers instead of being locked into a single utility.

• Pricing:

Calculated per unit of energy transported (Rs/kWh or $/MWh).

• Context in Pakistan:

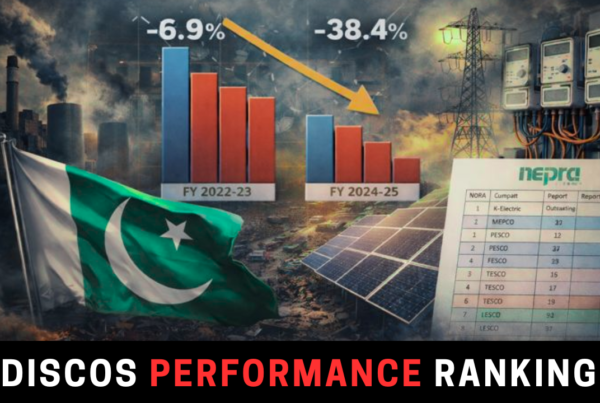

Wheeling charges have historically been high due to cross-subsidies. The current move reduces this burden by about Rs 4.04/kWh, materially improving the economics of wheeled power.

This matters because wheeling is the backbone of distributed and renewable energy markets. Without reasonable wheeling charges, solar and captive power remain confined to on-site use. With them, energy can move.

What actually changed — and what did not

Changed:

• Wheeling charges reduced by ~Rs 4.04/kWh through partial removal of cross-subsidies

• Effective wheeling cost now ~Rs 8.5–9/kWh (varies by consumer class)

Not changed (so far):

• Base electricity tariffs for all industrial consumers

• NEPRA-notified uniform tariff schedules (pending formal notifications)

This distinction is critical. Calling this a “tariff cut” is technically inaccurate. It is wheeling relief, delivered through restructuring, not across-the-board pricing.

Why this is especially relevant for solar and energy-intensive industry

For energy-intensive sectors—textiles, chemicals, engineering, food processing—electricity is not a variable cost. It defines competitiveness.

Lower wheeling charges mean:

• Off-site solar becomes viable (industrial parks, multi-location businesses)

• Captive and third-party solar projects pencil out faster

• Open-access power procurement faces fewer artificial penalties

• Long-distance renewable delivery is no longer price-prohibitive

In practical terms, wheeling reform is one of the few levers that directly connects energy policy with industrial competitiveness and renewable adoption.

This is precisely why industry bodies have long demanded removal of cross-subsidies from industrial power pricing—and why this step, while limited, is directionally correct.

A note on export competitiveness (brief, but relevant)

While financing relief for exporters was also mentioned in the same policy window, the real, durable competitiveness gain comes from energy structure, not interest rates alone. For exporters considering solar to stabilize costs and margins, wheeling reform is the more consequential signal.

Cheaper financing helps cash flow.

Cheaper, movable energy reshapes business models.

What businesses should watch next

• Formal notifications from the Power Division and NEPRA

• Applicability by consumer class (not all industries benefit equally)

• Loss assumptions and voltage-level charges in wheeling calculations

• Further cross-subsidy unwind in future budgets

Announcements move sentiment. Notifications move balance sheets.

Why this matters for Zorays.com readers

For businesses evaluating solar EPC, captive plants, hybrid systems, or third-party solar supply, wheeling charges are no longer a footnote—they are a strategic variable.

A rational wheeling regime enables:

• Distributed solar beyond rooftops

• Portfolio-level energy planning

• Cleaner power without geographic constraints

This reform does not solve Pakistan’s energy problem. But it removes one of the biggest distortions blocking renewable-led industrial growth.