NEPRA’s DISCO Rankings (2021–25) expose the real problem: distribution inefficiency. Meanwhile, industrial and agricultural demand is collapsing and solar is becoming the only reliable power solution.

Pakistan’s power sector isn’t facing a “solar problem.”

It’s facing a distribution governance problem — and the numbers are now screaming.

While policy circles keep obsessing over net metering and “recovering revenue” through net billing, the grid is losing something far more dangerous:

✅ Industrial electricity demand

✅ Agricultural electricity demand

✅ And ultimately, Pakistan’s ability to compete, export, and employ

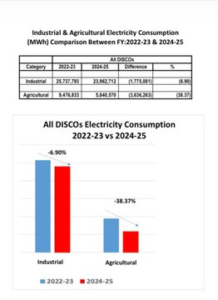

The latest DISCO consumption comparisons between FY 2022–23 and FY 2024–25 reveal a hard truth: people are leaving the grid. And when demand leaves, the entire tariff structure collapses onto whoever stays behind — mainly industry, the very segment Pakistan can’t afford to kill.

The Alarm Bell: Industrial Demand Down 6.9% in Two Years

Across all DISCOs, industrial consumption fell from 25.74 TWh (FY22–23) to 23.96 TWh (FY24–25) — a decline of 6.9%.

Across all DISCOs, industrial consumption fell from 25.74 TWh (FY22–23) to 23.96 TWh (FY24–25) — a decline of 6.9%.

That drop is not a “small adjustment.” It is a structural message:

Industry is being priced out of the grid.

Even more revealing: this happened despite ~1,000 MW of captive gas-based power plants reconnecting to the grid in the last year, which should have lifted consumption — not reduced it.

A grid that becomes expensive, unstable, and overtaxed doesn’t attract demand.

It repels it.

Agriculture Is Exiting Faster: Consumption Down 38.37%

Agriculture demand collapsed even harder.

Agriculture demand collapsed even harder.

Across all DISCOs, agricultural consumption dropped from 9.48 TWh to 5.84 TWh — a stunning 38.37% decline over the same period.

That isn’t “efficiency improvement.”

That is grid abandonment.

Farmers don’t stop using electricity because they suddenly love diesel or darkness. They reduce grid usage because:

-

tariffs have become unbearable,

-

load-shedding and low voltage destroy motors,

-

recovery pressure creates harassment,

-

and solar has become an economic escape hatch.

DISCO-wise Proof: The Grid Is Not Losing Demand Equally

Charts show the decline is not uniform.

Industrial consumption highlights (FY22–23 vs FY24–25)

-

LESCO: -9.97%

-

FESCO: -7.99%

-

IESCO: -12.96%

-

MEPCO: -3.56%

-

PESCO: -15.22%

-

TESCO: -13.17%

-

GEPCO increased slightly: +4.39%

-

HESCO: +17.93%

-

QESCO: +8.44%

The key takeaway is not who moved up or down by a few points.

The bigger story is this:

Industrial demand is weakening overall, and in several regions the contraction is sharp enough to signal reduced industrial activity or self-generation migration.

Agricultural consumption highlights (FY22–23 vs FY24–25)

The agriculture decline is widespread and brutal:

-

LESCO: -32.77%

-

GEPCO: -32.02%

-

FESCO: -40.72%

-

MEPCO: -39.74%

-

QESCO: -41.35%

-

ALL DISCOs: -38.37%

That’s not “tariff reform working.”

That’s demand leaving the billing system.

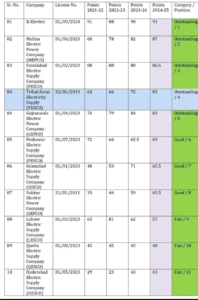

Now Add NEPRA’s DISCO Performance Rankings (2021–25): The Real Culprit Appears

Here’s where the story becomes undeniable.

Here’s where the story becomes undeniable.

NEPRA ranking table (2021–22 to 2024–25 points) shows the distribution side is not performing equally.

Outstanding (Top 5)

-

K-Electric — Outstanding / #1 (91 in 2024–25)

-

MEPCO — Outstanding / #2 (87 in 2024–25)

-

FESCO — Outstanding / #3 (86.5 in 2024–25)

-

TESCO — Outstanding / #4 (83 in 2024–25)

-

GEPCO — Outstanding / #5 (83 in 2024–25)

Good

-

PESCO — Good / #6 (69 in 2024–25)

-

IESCO — Good / #7 (65.5 in 2024–25)

-

SEPCO — Good / #8 (65.5 in 2024–25)

Fair (Bottom performers)

-

LESCO — Fair / #9 (57 in 2024–25)

-

QESCO — Fair / #10 (48 in 2024–25)

-

HESCO — Fair / #11 (43 in 2024–25)

So Pakistan’s demand collapse is happening inside a distribution landscape where:

✅ Some utilities score in the 80s and 90s

❌ Others can’t break past the 40s or 50s

That means policy must stop pretending that “the grid” is one single machine.

It is multiple utilities with very different capabilities.

The Cross-Subsidy Trap: Industry Is Paying For a System That’s Shrinking

Once domestic and agricultural consumers slide into lower slabs or leave the grid, the fixed cost burden doesn’t vanish.

Capacity payments remain.

Transmission costs remain.

DISCO inefficiencies remain.

So what happens?

The remaining paying consumer gets crushed.

That paying consumer is industry.

This is why cross-subsidy becomes deadly: it converts electricity into an industrial penalty.

And when industry gets penalized long enough, it stops expanding — and then it stops existing.

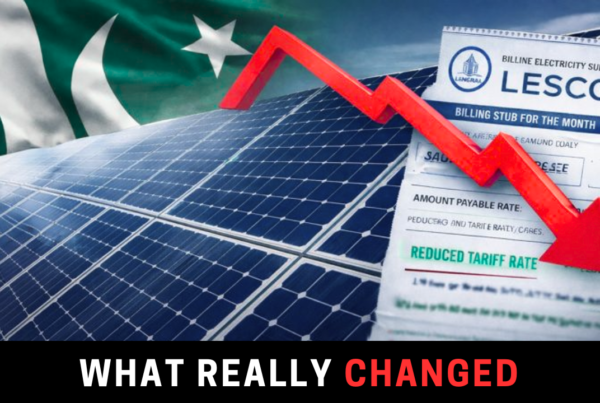

Net Billing Is a Blunt Weapon — And It Will Backfire

The Power Division’s obsession with discouraging net metering through net billing assumes one thing:

“Solar consumers are the reason the system is expensive.”

That is false.

The system is expensive because:

-

generation contracts are rigid,

-

inefficiencies in distribution persist,

-

and losses + recovery failures are socialized through tariffs.

Net billing doesn’t fix this.

It only changes who gets punished first.

And the policy outcome is predictable:

If you kill net metering incentives…

People won’t return to the grid.

They will simply move from:

✅ grid + solar

to

❌ solar + batteries + off-grid

That means:

-

even less demand on DISCO feeders

-

even less revenue collection

-

even more tariff pressure on industry

-

and an even faster death spiral

Net billing doesn’t save the grid.

It accelerates grid irrelevance.

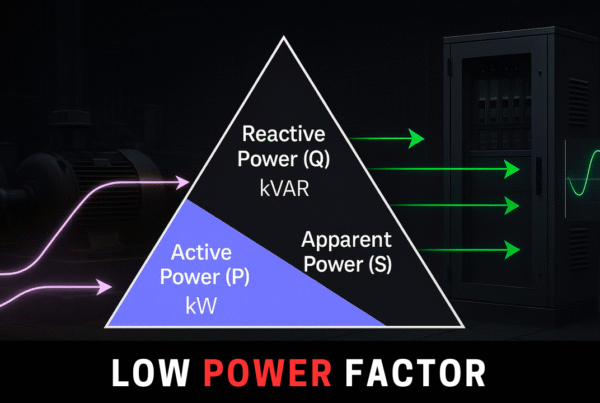

Solar’s Competitive Advantage Isn’t Only Price — It’s Power Quality

Industrial users don’t suffer only from high tariffs.

They suffer from bad waveform quality:

-

voltage sags

-

spikes

-

outages

-

sensitive machinery damage

-

productivity loss

Solar + modern inverters provide:

-

stable voltage regulation

-

predictable output

-

better compatibility with industrial loads

-

and increasingly, battery-backed continuity

That’s why industries don’t just “save money” with solar.

They secure operational survival.

What Pakistan Should Do Instead: The Fix Is Not Anti-Solar — It’s Pro-Industry + Pro-Efficiency

If the state wants to restore demand and stop the tariff spiral, the strategy is simple:

1) Remove cross-subsidy burden from industrial tariffs

Industry must not be the dumping ground for distribution failure.

2) Renegotiate expensive IPPs aggressively

Especially high-tariff coal and wind contracts that keep base tariffs inflated.

3) Upgrade net metering instead of destroying it

Instead of net billing punishment:

-

introduce time-of-use net metering

-

apply rational fixed charges transparently

-

encourage storage for peak management

-

register and monitor solar properly

4) Benchmark DISCOs using NEPRA rankings

If KE, MEPCO, FESCO can perform, the others must be forced to improve.

No more blanket policy for unequal performers.

The Bottom Line: Don’t Kill the Only Escape Valve While the House Is Burning

The DISCO consumption data shows demand is shrinking.

The NEPRA scoring shows distribution performance is uneven.

The cross-subsidy burden is already a threat.

Industry is already under pressure.

And in the middle of this, the state wants to discourage net metering?

That’s not reform.

That’s misdiagnosis.

Because the real reform isn’t:

❌ “make solar unattractive”

It’s:

✅ “make the grid worthy again”

Until then, consumers will keep leaving.

And if the industrial base collapses, the country won’t just lose units.

Pakistan will lose:

-

exports

-

jobs

-

investment

-

and economic sovereignty.